The right to appeal under the Income Tax Act allows taxpayers to challenge decisions made by tax authorities when they believe the assessment or tax-related orders are incorrect. This right ensures that individuals and entities are not unduly penalized due to mistakes or misinterpretations of the law. In this blog, we will delve into the right to appeal under the Income Tax Act, explaining in detail what it entails, the process involved, the relevant sections, and notable case law. By the end, you will have a clear understanding of how and when you can appeal a tax decision.

What is an Appeal?

An appeal is a legal process where a person, usually an assessee (the taxpayer), challenges a decision made by a tax authority. In the context of the Income Tax Act, this typically involves challenging orders passed by the Assessing Officer (AO) or other tax authorities like the Commissioner of Income Tax (Appeals) (CIT(A)) or Income Tax Appellate Tribunal (ITAT).

However, the right to appeal is not automatic. It must be granted by the Income Tax Act itself, which lays down the conditions and procedures for filing an appeal. This ensures that the right to challenge decisions is structured and based on specific statutory provisions.

The Statutory Basis for the Right to Appeal

Under the Income Tax Act, the right to appeal arises only when explicitly provided by the statute. This principle was established in the case CIT v. Ashoka Engineering Co. (1992) 194 ITR 645 (SC), where the Supreme Court emphasized that no appeal can be filed unless the statute specifically grants that right.

Alternative Remedies: Writ Petitions

In some cases, when the appeal process is not available or the taxpayer is unable to pursue an appeal within the specified time frame, they may resort to filing a writ petition under Article 226 of the Constitution of India. However, as per the ruling in Mahesh Kumar Agarwal v. PCIT (2019) 105 taxmann.com 273 (SC), if there is an alternative remedy, like filing an appeal, a writ petition will generally not be entertained. This ensures that appeals are the primary mode of dispute resolution in tax matters.

What Orders Can Be Appealed Under the Income Tax Act?

The Income Tax Act specifies several types of orders against which an appeal can be filed. These include orders passed by the Assessing Officer (AO), Commissioner of Income Tax (Appeals) (CIT(A)), and other authorities. Below are some of the key orders against which appeals can be filed:

1. Assessment Orders (Section 143, 144, and 147)

One of the most common reasons for filing an appeal is against assessment orders. The AO may pass an order under sections 143(3) (regular assessment), 144 (best judgment assessment), or 147 (reassessment).

Example:

If a taxpayer’s income has been reassessed under Section 147 and the taxpayer believes that the reassessment was incorrect, they can file an appeal with the CIT(A).

2. Penalty Orders (Chapter XXI)

Penalties can be imposed by the Assessing Officer for various offenses, such as failure to file returns or underreporting income. These penalty orders are appealable to the CIT(A) under Section 246A of the Income Tax Act.

Example:

If an individual receives a penalty notice for underreporting income, they can file an appeal to the CIT(A) to challenge the penalty.

3. Reassessment and Rectification Orders (Sections 147, 154)

A taxpayer can appeal against orders for reassessment or rectification. For example, if the AO revises the income of a taxpayer under Section 147 (reassessment), or corrects an error in the earlier assessment under Section 154 (rectification), these orders are also open to challenge.

4. Refund Orders (Section 237)

If a taxpayer is dissatisfied with the amount of refund granted or denied, they can appeal the order before the CIT(A).

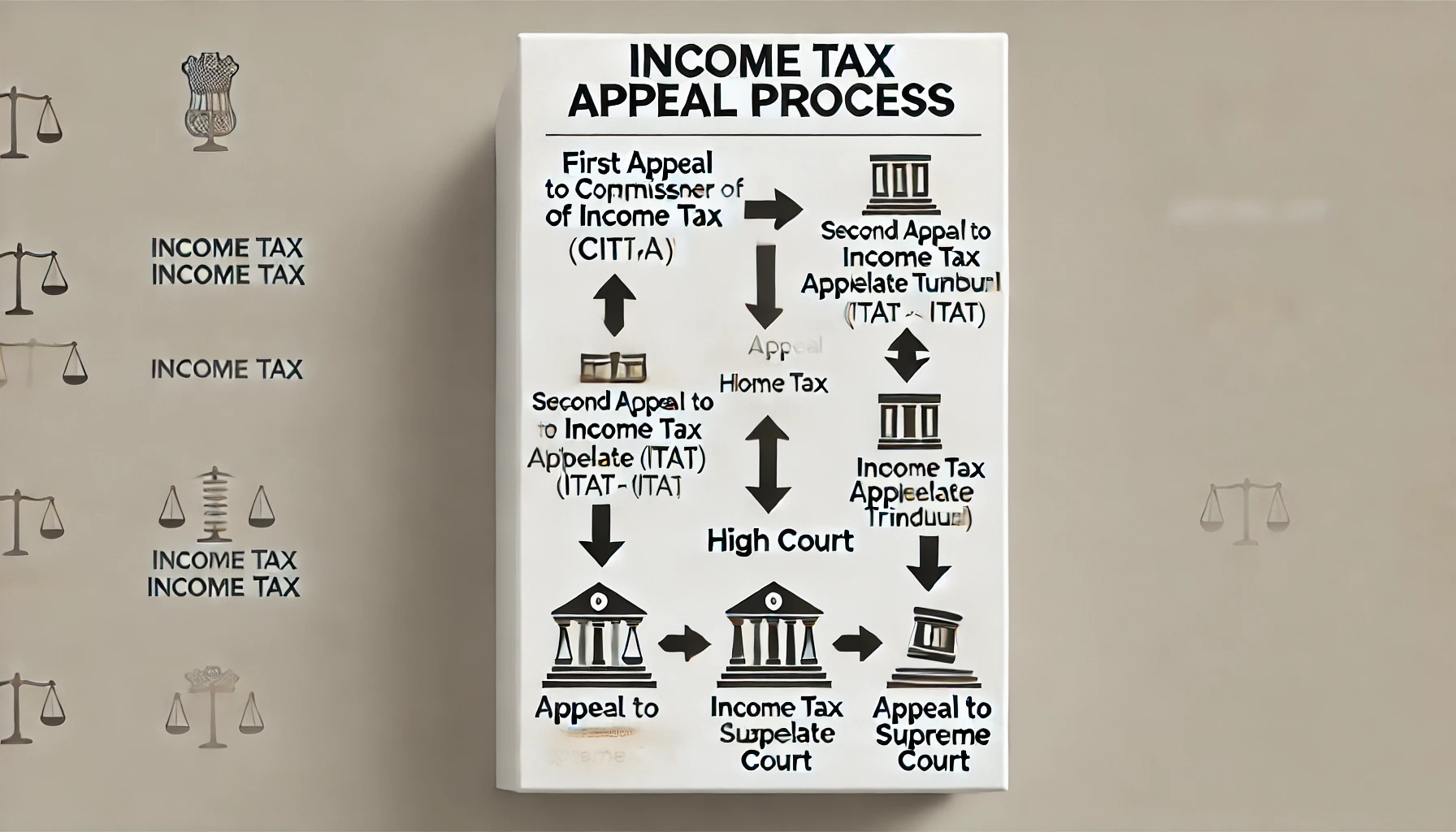

The Appeal Process: Steps Involved

The appeal process under the Income Tax Act involves several stages. Here is a detailed look at the procedure:

Step 1: Filing the First Appeal

The first step in the appeal process is to file the appeal with the CIT(A). This must be done in Form No. 35 and within 30 days from the date of receiving the order or notice. If the taxpayer is not satisfied with the assessment order, they must appeal to the CIT(A), who has the authority to review and decide on the case.

Details of Form No. 35:

Form No. 35 is the official form used for filing an appeal with the CIT(A). The form requires the appellant to provide details such as the appeal grounds, statement of facts, and the order being challenged.

You can download Form No. 35 here: Form No. 35 – Appeal Form

Penalties for Filing Appeal:

- Fee: A fee must be paid while filing the appeal. The amount depends on the total income. For example:

- If total income exceeds ₹2 lakh but is less than ₹10 lakh, the fee is ₹500.

- If total income exceeds ₹10 lakh, the fee increases to ₹1,000.

Example of Filing an Appeal:

If a taxpayer has filed a return showing income of ₹15,00,000, and the AO assessed income at ₹20,00,000, the taxpayer can appeal the assessment order to the CIT(A) by submitting Form No. 35. The appeal fee for income exceeding ₹10 lakh would be ₹1,000.

Step 2: Second Appeal to the ITAT

If the taxpayer is not satisfied with the decision of the CIT(A), they can file a second appeal with the Income Tax Appellate Tribunal (ITAT). The time limit for filing the second appeal is 60 days from the date of receiving the CIT(A)’s order.

Step 3: Appeal to the High Court

If the case involves a substantial question of law, the taxpayer or the CIT can appeal the ITAT’s decision to the High Court.

Step 4: Appeal to the Supreme Court

The Supreme Court can hear appeals against the High Court’s decision if the case involves significant legal issues.

Important Sections to Know for Filing an Appeal

1. Section 246A: Orders Appealable to the CIT(A)

This section defines the orders against which an appeal can be filed with the CIT(A), including assessments under sections 143(3), 144, and 147, and penalty orders under Chapter XXI.

2. Section 249: Procedure for Filing an Appeal

This section outlines the process for filing an appeal with the CIT(A), including the form to be used (Form No. 35) and the time limits.

3. Section 253: Appeal to the ITAT

Section 253 provides for the second appeal to the Income Tax Appellate Tribunal (ITAT). It includes the time limits and other procedural aspects.

High Court and Supreme Court Decisions

- CIT v. Ashoka Engineering Co. (1992) 194 ITR 645 (SC):

- This case established that the right to appeal is statutory and can only be exercised if the law provides for it.

- Mahesh Kumar Agarwal v. PCIT (2019) 105 taxmann.com 273 (SC):

- The Supreme Court ruled that when there is an alternative remedy available under the Income Tax Act (such as filing an appeal), a writ petition cannot be filed before the High Court.

- Genpact India (P.) Ltd. v. DCIT (2019) 108 taxmann.com 340 (Del):

- The Delhi High Court ruled that if an alternative remedy of appeal is available, a writ petition under Article 226 is not maintainable.

Conclusion

The right to appeal is a critical tool in the Income Tax Act that ensures taxpayers can challenge any unjust decisions or errors made by tax authorities. The process is systematic and includes various levels of appeal from the CIT(A) to the Supreme Court. Understanding the relevant sections, forms, and deadlines is crucial for taxpayers to effectively use their right to appeal.

Additional Resources

Learn more about Tax Provisions on the official Income Tax India website.

Want to consult a professional? Contact us: 09463224996

For more information and related blogs, click here.