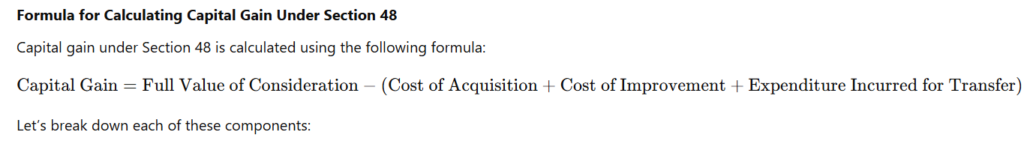

Capital gains tax is an essential part of the income tax framework, impacting individuals and businesses who sell or transfer capital assets. Under Section 48 of the Income Tax Act, 1961, the calculation of capital gains is defined, and various deductions are available to reduce the taxable amount. In this blog, we will break down how capital gain is calculated under Section 48 and discuss the various deductions available to taxpayers.

Understanding Capital Gains Tax Calculation

Capital gain is the profit derived from the sale of a capital asset, such as land, property, shares, or bonds. It is computed as the difference between the sale consideration (or selling price) and the cost of acquisition of the asset, along with any cost of improvement made to it.

Let’s break down each of these components:

1. Full Value of Consideration

The Full Value of Consideration refers to the amount received or receivable by the taxpayer on the sale or transfer of the capital asset. This is essentially the selling price of the asset.

- Example: If you sell a plot of land for ₹20,00,000, then ₹20,00,000 is the full value of consideration.

2. Cost of Acquisition

The Cost of Acquisition is the price at which the capital asset was originally purchased or acquired by the taxpayer. For assets like property, the cost of acquisition is typically the purchase price.

However, for assets like shares or bonds, the acquisition cost can include not only the price paid for the asset but also other associated costs, such as brokerages or commissions.

- Example: If you bought the plot of land for ₹10,00,000, then the cost of acquisition is ₹10,00,000.

For inherited assets, the cost of acquisition is the fair market value at the time of inheritance.

3. Cost of Improvement

The Cost of Improvement refers to any expenditure incurred to enhance the value of the capital asset. This could include any costs related to renovating, repairing, or upgrading the asset.

It is important to note that the cost of improvement does not include routine maintenance costs, such as painting or fixing minor defects. Only capital expenditures that increase the asset’s value are considered here.

- Example: If you spent ₹2,00,000 on constructing a house on the plot of land you sold, that amount will be added to the cost of improvement.

4. Expenditure Incurred for Transfer

The expenditure incurred for transfer includes any costs directly related to the sale of the asset, such as brokerage fees, legal fees, registration charges, or commission paid to agents.

These costs reduce the overall capital gain, thereby reducing the taxable amount.

- Example: If you paid ₹50,000 as brokerage fees and ₹25,000 in legal charges while transferring the land, this total of ₹75,000 will be deducted from your capital gains.

Deductions Available Under Section 48

While Section 48 specifies the method of calculating capital gains, it also allows for several deductions to reduce the amount of taxable gain. Here are the key deductions available:

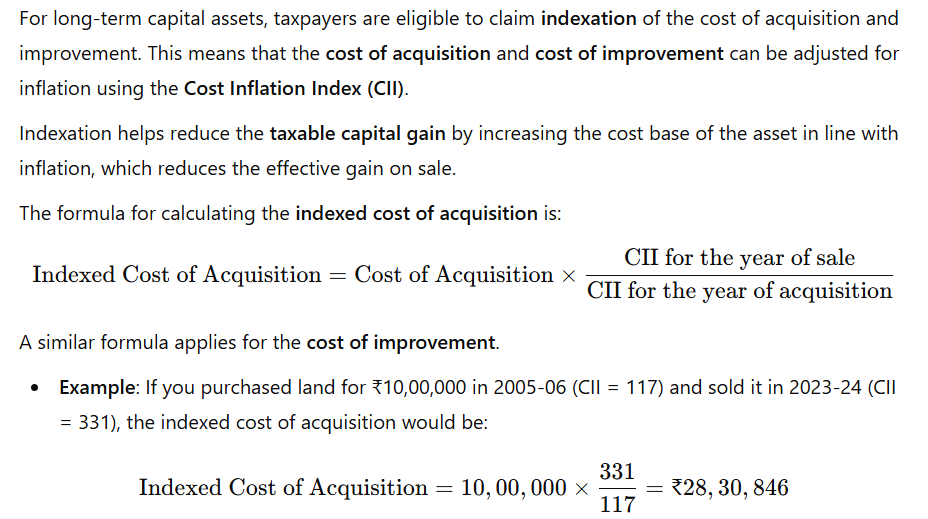

1. Indexed Cost of Acquisition and Improvement

This adjusted amount reduces the taxable capital gain when you sell the asset.

2. Exemptions for Long-Term Capital Gains (LTCG)

In addition to deductions, certain exemptions are available for long-term capital gains under various sections of the Income Tax Act, such as Section 54, Section 54B, and Section 54EC.

- Section 54: Exemption for long-term capital gains on the sale of a residential property, if the proceeds are reinvested in another residential property.

- Section 54B: Exemption on capital gains arising from the sale of agricultural land, if the proceeds are reinvested in another agricultural land.

- Section 54EC: Exemption for investment in specified bonds (like NHAI or REC bonds) to save tax on long-term capital gains.

These exemptions help in reducing the overall capital gain subject to tax.

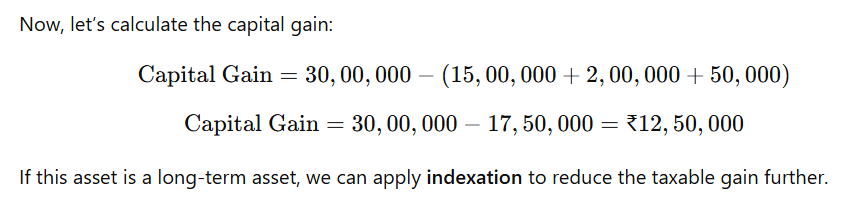

Example Calculation of Capital Gain

Let’s consider an example to illustrate how capital gain is calculated:

- Full Value of Consideration (Sale Price): ₹30,00,000

- Cost of Acquisition: ₹15,00,000

- Cost of Improvement: ₹2,00,000

- Expenditure Incurred for Transfer: ₹50,000

Conclusion

Section 48 provides a detailed framework for calculating capital gains, ensuring that the sale of a capital asset is taxed fairly by accounting for the original cost of the asset, any improvements made, and any expenditures incurred for its transfer. The available deductions—such as indexation and exemption provisions—help reduce the taxable gain, providing tax relief to long-term investors.

By understanding the calculation process and utilizing available deductions, taxpayers can effectively manage their tax liability when transferring capital assets.

Additional Resources

Learn more about Tax Provisions on the official Income Tax India website.

Want to consult a professional? Contact us: 09463224996

For more information and related blogs, click here.