When it comes to calculating long-term capital gains (LTCG), understanding the concept of indexed cost of acquisition and indexed cost of improvement is essential. These factors play a crucial role in reducing the taxable capital gain, thereby minimizing the tax liability. Under the Income Tax Act, 1961, indexation allows taxpayers to adjust the cost of acquisition and cost of improvement of long-term capital assets for inflation, ensuring that the impact of inflation on the value of the asset is considered.

In this blog, we will explain the role of indexed cost of acquisition and indexed cost of improvement in the calculation of long-term capital gains and how these adjustments can significantly lower the tax burden.

Understanding Indexed Cost of Acquisition and Improvement

Before we dive into their role in calculating long-term capital gains, let’s understand what these terms mean.

Indexed Cost of Acquisition

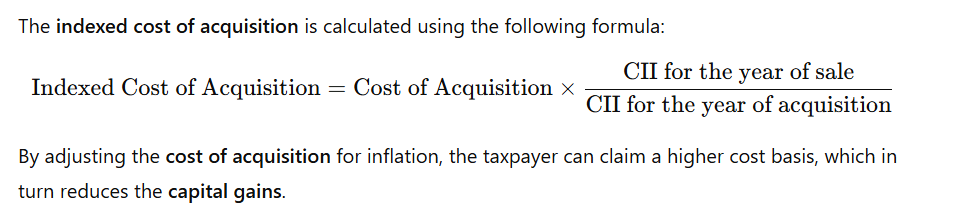

The cost of acquisition refers to the amount paid by the taxpayer to acquire the asset. When calculating long-term capital gains, the indexed cost of acquisition is the cost of the asset adjusted for inflation. This adjustment is done using the Cost Inflation Index (CII), which is notified by the Central Government every year.

By adjusting the cost of acquisition for inflation, the taxpayer can claim a higher cost basis, which in turn reduces the capital gains.

Indexed Cost of Improvement

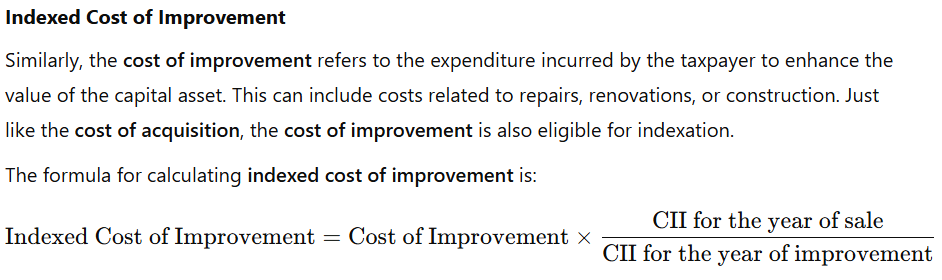

Similarly, the cost of improvement refers to the expenditure incurred by the taxpayer to enhance the value of the capital asset. This can include costs related to repairs, renovations, or construction. Just like the cost of acquisition, the cost of improvement is also eligible for indexation.

Indexing the cost of improvement ensures that the taxpayer receives credit for the inflationary increase in the cost of improvements made to the asset over time.

Role of Indexed Cost in Reducing Long-Term Capital Gains

The primary benefit of indexation is that it allows taxpayers to account for the effect of inflation on their capital assets. Without indexation, the capital gains would be calculated based on the original purchase price (without considering inflation), which could lead to a higher taxable gain.

The indexation of both the cost of acquisition and cost of improvement increases the cost basis of the asset, effectively reducing the taxable long-term capital gain. This results in a lower amount of tax payable on the capital gain.

Example: Calculating LTCG with Indexation

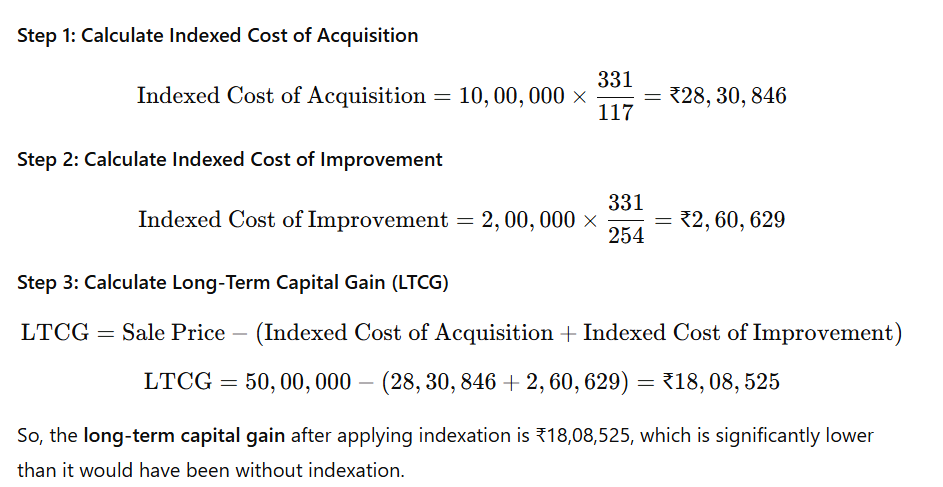

Let’s consider an example to demonstrate how indexation works in the calculation of long-term capital gains:

- Sale Price (Full Value of Consideration): ₹50,00,000

- Cost of Acquisition (original purchase price in 2005): ₹10,00,000

- Cost of Improvement (for renovations in 2015): ₹2,00,000

- Cost Inflation Index (CII):

- CII for 2005: =117

- CII for 2023: =331

- CII for 2015: =254

Benefits of Indexation for Taxpayers

- Reduces Taxable Capital Gain: Indexation increases the cost of acquisition and cost of improvement, reducing the capital gain on the sale of the asset, and thus the tax payable.

- Inflation Adjustment: Indexation adjusts the cost to reflect the inflationary increase in the value of the asset, which helps in ensuring a fair taxation process.

- Encourages Long-Term Investment: By reducing the tax burden on long-term investments, indexation encourages taxpayers to hold assets for a longer duration, thereby promoting long-term capital formation.

- Improves Financial Planning: Indexation helps taxpayers in estimating their tax liabilities more accurately and plan their financial activities accordingly.

When Does Indexation Apply?

Indexation is only applicable to long-term capital assets (assets held for more than 36 months, or 24 months for immovable property). The indexation benefit is not available for short-term capital gains, as these assets are taxed at a higher rate without any adjustments for inflation.

Conclusion

The indexed cost of acquisition and indexed cost of improvement play a crucial role in calculating long-term capital gains under the Income Tax Act. By adjusting the original cost of the asset for inflation, indexation helps in reducing the taxable gain, ultimately lowering the tax liability for the taxpayer.

Understanding indexation and its application can significantly benefit investors and taxpayers, especially in the context of long-term assets like property, stocks, and mutual funds. It ensures that the tax burden is fair and reflects the actual gain after accounting for inflation.

Additional Resources

Learn more about Tax Provisions on the official Income Tax India website.

Want to consult a professional? Contact us: 09463224996

For more information and related blogs, click here.