The transfer of depreciable assets triggers specific tax implications under the Income Tax Act, 1961. Depreciable assets are those assets on which depreciation is claimed as a deduction under Section 32 of the Act. These typically include assets like machinery, vehicles, buildings, and equipment, which lose value over time due to wear and tear. However, when such assets are sold or transferred, the calculation of capital gains becomes more complex due to the application of Section 50 of the Income Tax Act.

In this blog, we will explore the key provisions of Section 50 and explain how capital gains are calculated on the transfer of depreciable assets.

What Does Section 50 Say?

Section 50 of the Income Tax Act specifically deals with the calculation of capital gains on the sale or transfer of depreciable assets. Depreciable assets are those that are eligible for depreciation, and the tax treatment of their sale differs from other types of capital assets.

The key aspect of Section 50 is that it does not allow for indexation benefits while calculating capital gains on depreciable assets. Instead, the provisions of Section 50 apply to calculate short-term capital gains (STCG) when such assets are sold. The concept of depreciation recapture also plays an essential role in determining the final tax liability.

Key Provisions of Section 50:

| Provision | Details |

|---|---|

| Short-Term Capital Gains | When depreciable assets are sold, short-term capital gains (STCG) arise, irrespective of holding period. |

| No Indexation | Unlike other assets, no indexation is allowed on depreciable assets for calculating capital gains. |

| Depreciation Recapture | The amount of depreciation claimed in earlier years is added back to the capital gain to determine the taxable amount. |

| Cost of Acquisition | The cost of acquisition is the original purchase price or book value after accounting for depreciation. |

How Are Capital Gains Calculated Under Section 50?

The calculation of capital gains on the transfer of depreciable assets is a two-step process:

1. Calculate the Sale Price:

The sale price is the price at which the depreciable asset is transferred. It could be the actual sale consideration or the fair market value (FMV) at the time of transfer, depending on the terms of the agreement.

2. Determine the Depreciation Recapture:

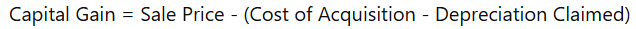

Under Section 50, the amount of depreciation claimed in earlier years must be “recaptured” and included in the capital gain calculation. This means the amount of depreciation deducted from the asset’s value in prior years is added back to the final capital gains calculation. The process for calculating capital gains in the case of a depreciable asset is:

If the sale price exceeds the written-down value (WDV) of the asset, the excess amount is treated as capital gains. If the sale price is lower than the WDV, there may be no capital gains, but the taxpayer may face depreciation recapture.

Example: Depreciation Recapture in Capital Gains Calculation

Let’s go through an example to understand the calculation better:

| Details | Amount (₹) |

|---|---|

| Original Purchase Price of Asset | ₹10,00,000 |

| Depreciation Claimed Over 5 Years | ₹3,00,000 |

| Written-Down Value (WDV) | ₹7,00,000 (₹10,00,000 – ₹3,00,000) |

| Sale Price of Asset | ₹8,00,000 |

| Capital Gain | ₹8,00,000 – ₹7,00,000 = ₹1,00,000 |

Step 1: Calculate Capital Gain

- The capital gain is ₹1,00,000, as the sale price of ₹8,00,000 is more than the WDV of ₹7,00,000.

Step 2: Depreciation Recapture

The total depreciation claimed is ₹3,00,000, which must be added back to the capital gain.

Therefore, the capital gain becomes ₹4,00,000 (₹1,00,000 capital gain + ₹3,00,000 depreciation recapture).

Tax Treatment Under Section 50

- Short-Term Capital Gain (STCG): The gain on the sale of depreciable assets is treated as short-term capital gain (STCG), irrespective of the holding period of the asset. This is because the asset was subject to depreciation, and the sale is considered a short-term transaction.

- No Indexation: Since indexation is not available for depreciable assets under Section 50, the taxpayer cannot adjust the cost of acquisition based on inflation or the rise in the cost of living, as they would for other types of long-term assets.

- Tax Rate: The tax rate on short-term capital gains arising from the transfer of depreciable assets is typically 30% (plus surcharge and cess) for individuals, or higher rates may apply depending on the taxpayer’s income bracket.

Key Considerations for Depreciable Asset Transfers

- Depreciation Recapture: One of the most critical aspects of calculating capital gains on depreciable assets is the depreciation recapture. The depreciation claimed over the years must be added back to the capital gain calculation.

- Short-Term Nature of the Gain: Even if the asset is held for a long period, the capital gain is still classified as short-term capital gain due to the depreciation claimed. This impacts the tax rate, as STCG is taxed at a higher rate than long-term capital gains (LTCG).

- Asset’s Written-Down Value: The written-down value (WDV) plays a vital role in determining the capital gain. The WDV is the original cost of acquisition minus the depreciation claimed.

- Impact on Tax Liability: The lack of indexation means that tax liabilities on depreciable assets may be higher compared to other long-term assets where indexation is allowed.

Conclusion

Section 50 of the Income Tax Act outlines the rules for calculating capital gains on the transfer of depreciable assets, which differs significantly from the calculation of gains on other types of property. The main elements of the calculation are the sale price, the written-down value (after depreciation), and the depreciation recapture.

It is important for taxpayers to be aware that depreciable assets are subject to short-term capital gains tax, regardless of the holding period, and no indexation benefits are available. Understanding these rules helps in better tax planning when transferring depreciable assets such as machinery, vehicles, or real estate used for business purposes.

Additional Resources

Learn more about Tax Provisions on the official Income Tax India website.

Want to consult a professional? Contact us: 09463224996

For more information and related blogs, click here.