Section 43B(h):

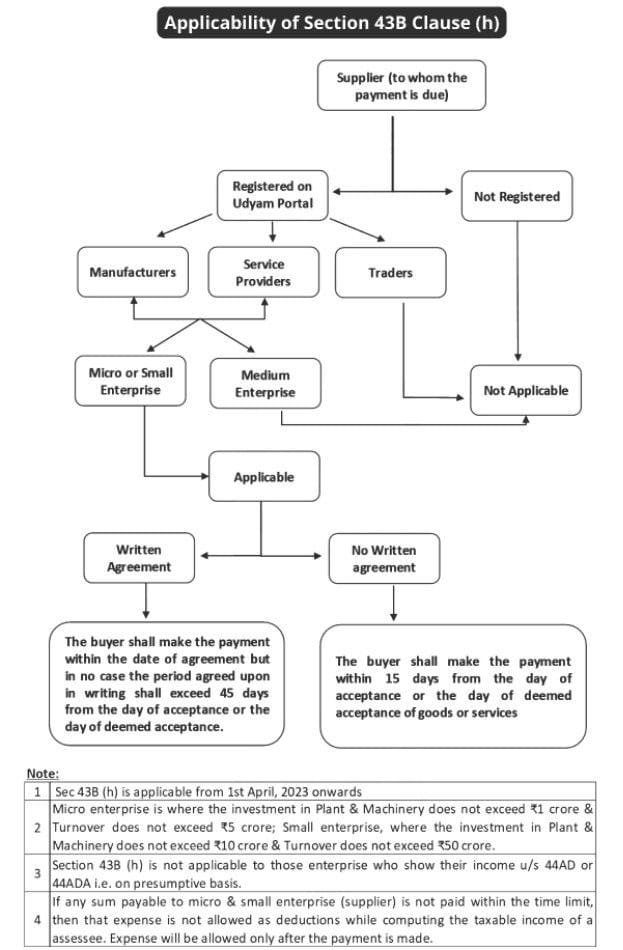

Section 43B(h) was introduced by the Finance Act of 2023 and came into effect from the assessment year 2024–2025, which corresponds to the Financial Year 2023-24. This clause primarily deals with deductions related to payments owed to Micro, Small, and Medium Enterprises (MSMEs) for goods supplied or services rendered.

Under this provision, if an Assessee, who is liable to make payments to an MSME, settles the outstanding dues within the timeframe prescribed by the Micro, Small, and Medium Enterprises Development (MSMED) Act, 2006, the deduction for such payments can be claimed in the same financial year.

Here are some examples illustrating the application of Section 43B(h):

Table

| Sr. No. | Date of Acceptance of Goods/Services by Buyer from Supplier | Credit Period (Days) | Actual Date of Payment | Deduction Allowed in Which FY |

|---|---|---|---|---|

| 1 | 29/03/2024 | 60 | 25/05/2024 | FY 2024-25 |

| 2 | 01/04/2024 | 45 | 21/05/2024 | FY 2024-25 |

| 3 | 31/01/2024 | 15 | 20/02/2024 | FY 2023-24 |

| 4 | 11/09/2023 | 20 | 03/10/2023 | FY 2023-24 |

| 5 | 30/11/2023 | 30 | 20/12/2023 | FY 2023-24 |

| 6 | 21/04/2024 | 40 | 20/06/2024 | FY 2024-25 |

Additional Details and Clarifications:

1. Applicability to MSMEs Only: Section 43B(h) applies specifically to Micro or Small Enterprises, as defined by the MSME Development Act, 2006. Medium Enterprises are excluded from the purview of this provision.

2. Deadline for Deduction: The deduction for payments to MSMEs can only be claimed if the payment is made within the timeline stipulated by the MSMED Act, 2006. This timeline varies depending on the terms agreed upon between the parties or as specified by the Act.

3. Interest on Late Payments: In case of delayed payments to MSMEs, the assessee may be liable to pay interest. The rate of interest is typically calculated at a compound interest rate, which is usually three times the bank rate notified by the Reserve Bank of India (RBI).

4. Exclusions: This provision does not apply to Medium Enterprises, and it’s not applicable to taxpayers who opt for presumptive taxation under sections 44AD, 44ADA, or 44AE of the Income Tax Act, 1961.

5. Timing of Deduction: The deduction for payments to MSMEs can be claimed in the same financial year in which the payment is made, provided it meets the conditions outlined in Section 43B(h).

Conclusion:

Section 43B(h) aims to encourage timely payments to MSMEs by allowing deductions for such payments made within the specified timeline. It not only supports the financial health of MSMEs but also aligns with the government’s initiatives to promote and sustain the growth of the MSME sector in India..