The Income Tax Act, 1961 provides specific provisions for the taxation of capital gains arising from the compulsory acquisition of assets under Section 45(5A). When a government authority acquires a capital asset (such as land, property, or any other asset) from a taxpayer for public purposes, the tax treatment of the resulting capital gain is different from that of a regular sale or transfer.

In this blog, we will explain the provisions of Section 45(5A), how the compulsory acquisition of assets is treated for tax purposes, and the available exemptions related to such acquisitions.

What is Section 45(5A)?

Section 45(5A) deals with the taxation of capital gains that arise when a capital asset is acquired by the government or a government authority for a public purpose under compulsory acquisition. This includes land, buildings, or other properties that are acquired by the government under the provisions of various laws such as land acquisition laws, urbanization projects, or infrastructure development projects.

According to Section 45(5A), when a capital asset is compulsorily acquired, the capital gain will be deemed to have occurred at the time of acquisition, and the taxpayer will be liable to pay capital gains tax. However, there are specific exemptions and considerations under this section that impact the taxation of these gains.

Key Provisions Under Section 45(5A)

1. Deemed Transfer on Compulsory Acquisition

Under Section 45(5A), the compulsory acquisition of a capital asset is treated as a deemed transfer for the purpose of calculating capital gains. This means that, for tax purposes, the asset is treated as though it has been sold to the acquiring authority, and the capital gain is calculated on the market value of the asset at the time of acquisition.

- Example: If the government acquires a piece of land for ₹50,00,000, and the cost of acquisition was ₹10,00,000, the capital gain of ₹40,00,000 (₹50,00,000 sale price – ₹10,00,000 acquisition cost) will be deemed to have occurred.

2. Timing of Capital Gain Realization

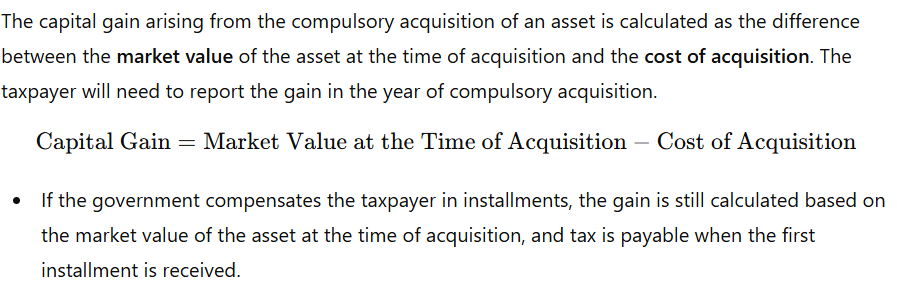

The capital gain is realized at the time of compulsory acquisition, even though the taxpayer may not receive the full compensation immediately. In many cases, compensation is paid over a period of time, and the taxpayer may receive additional amounts for things like interest or damages. However, the capital gain is taxed in the year of acquisition, and the taxpayer is required to report the gain in that year’s tax return.

Exemption Under Section 45(5A)

While Section 45(5A) makes capital gains arising from compulsory acquisition taxable, it also offers specific exemptions that can help reduce the tax liability. These exemptions are designed to mitigate the tax burden on individuals who lose their property to public purposes.

1. Reinvestment in Another Asset (Section 54F)

If the taxpayer reinvests the compensation received from the compulsory acquisition of a long-term capital asset (such as land) into the purchase of another residential property, they can avail of the exemption under Section 54F. This exemption allows the taxpayer to reduce or eliminate the tax liability on the capital gain by reinvesting in a new asset.

- The new residential property must be purchased within one year before or two years after the date of the compulsory acquisition.

- If the compensation exceeds the cost of the new residential property, the exemption will be proportionate to the reinvested amount.

Example: If the government acquires a piece of agricultural land for ₹50,00,000, and the taxpayer reinvests ₹45,00,000 into a new residential property, the capital gain will be reduced in proportion to the reinvested amount, subject to the conditions of Section 54F.

2. Compensation Paid in Installments

In some cases, the compensation for the compulsory acquisition is paid in installments over a period of time. Section 45(5A) provides a special provision for these cases, where the capital gain is considered to be realized in the year in which the first installment is received, even if the full compensation has not been paid yet.

- The taxpayer will be liable to pay tax on the capital gain based on the market value of the asset at the time of acquisition, even if the payments are staggered.

3. Section 54B: Reinvestment in Agricultural Land

Section 54B provides an exemption for capital gains arising from the sale or compulsory acquisition of agricultural land. The exemption is available if the taxpayer reinvests the proceeds in purchasing another agricultural land. This provision ensures that individuals who depend on agricultural land for their livelihood can continue their agricultural activities by purchasing new land with the proceeds from the compulsory acquisition.

- The new agricultural land must be purchased within two years of the sale or compulsory acquisition.

- Only the capital gain portion, not the entire sale proceeds, is eligible for exemption under Section 54B.

How is Capital Gain Calculated Under Section 45(5A)?

Example: Compulsory Acquisition of Agricultural Land

Let’s consider an example to illustrate how Section 45(5A) works:

- Sale Price (Compensation for Land): ₹50,00,000

- Cost of Acquisition: ₹10,00,000

- Capital Gain: ₹50,00,000 – ₹10,00,000 = ₹40,00,000

Step 1: Capital Gain Realized

Since the land is compulsorily acquired, the capital gain of ₹40,00,000 is realized, and the taxpayer will need to pay capital gains tax on this amount.

Step 2: Reinvestment in Residential Property

If the taxpayer reinvests the ₹40,00,000 capital gain into a new residential property, they can avail the exemption under Section 54F. The exemption will be available to the extent of the capital gain reinvested in the new property.

If only part of the capital gain is reinvested, the exemption will be proportional to the amount reinvested.

Conclusion

Section 45(5A) ensures that taxpayers who face compulsory acquisition of their assets are not unduly penalized by capital gains tax. The section treats the acquisition as a deemed transfer and taxes the resulting capital gain. However, exemptions under Sections 54F and 54B provide significant relief, particularly when the taxpayer reinvests the compensation in new assets, such as residential property or agricultural land.

Understanding the provisions of Section 45(5A) and related exemptions is important for taxpayers affected by compulsory acquisition, as it helps minimize their tax liability and allows them to maintain continuity in their investments.

Additional Resources

Learn more about Tax Provisions on the official Income Tax India website.

Want to consult a professional? Contact us: 09463224996

For more information and related blogs, click here.